Filing a claim with your homeowner’s insurance can be a daunting process, especially when you’re dealing with the aftermath of a loss or damage to your property. Understanding what to expect and how to navigate the process can make it much smoother and less stressful. In this guide, we’ll walk you through the steps of filing a claim in Florida, the role of public adjusters, and what documents you’ll need to prepare.

The Importance of Filing a Claim Correctly

Filing an insurance claim is a critical step in managing property damage or loss. Whether you’re dealing with storm damage, water leaks, or other issues, knowing the process and what to expect can help ensure that you receive the compensation you’re entitled to. In Florida, where weather events can be unpredictable, having a clear understanding of the claims process is essential.

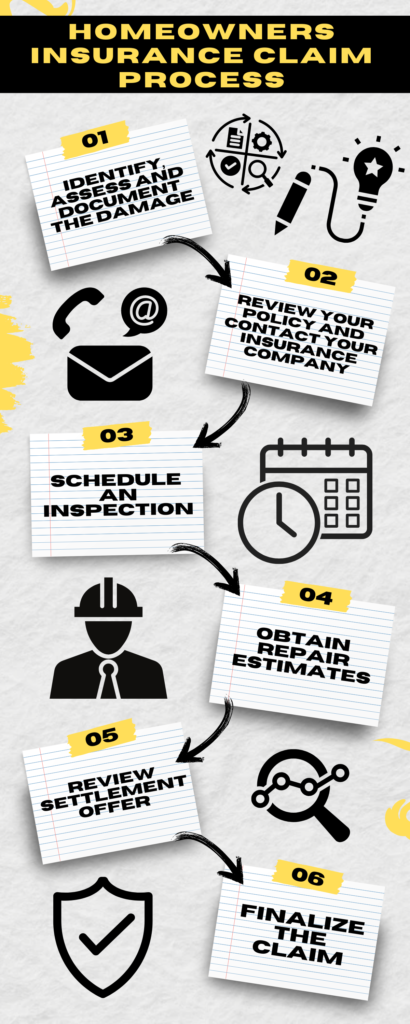

Step-by Step Walkthrough of Filing a Claim in Florida

- Assess the Damage

Before filing a claim, thoroughly examine the damage to your property. Document

everything with photos and notes. This initial assessment will be crucial for your

claim and help you provide accurate information to your insurance company. - Review Your Insurance Policy

Check your homeowner’s insurance policy to understand your coverage and any

exclusions. This will help you determine whether the damage is covered and

what limits or deductibles might apply. - Notify Your Insurance Company

Contact your insurance company to report the damage as soon as possible. Most

companies have a specific timeframe within which you must report a claim.

Provide them with the details of the damage and any supporting documentation

you have gathered. - Schedule an Inspection

The insurance company will typically send an adjuster to inspect the damage.

This step involves assessing the extent of the damage and determining the

amount of compensation you may be eligible for. Be prepared to answer

questions and provide any additional documentation they may request. - Obtain Repair Estimates

Get repair estimates from contractors or professionals to support your claim. This

will provide a clear picture of the costs involved and help substantiate your claim

with the insurance company. - Review the Settlement Offer

After the adjuster completes their inspection, the insurance company will issue a

settlement offer. Review this offer carefully. If it doesn’t cover your expenses or

seems insufficient, you have the right to negotiate or appeal the decision. - Finalize the Claim

Once you agree on a settlement amount, the insurance company will process the

payment. Ensure that all repairs are completed as agreed, and keep records of

all expenses related to the damage.

The Role of Public Adjusters During the Claim Process

Public adjusters are professionals who can assist you throughout the claims process. Unlike insurance company adjusters, who represent the insurer’s interests, public adjusters work on your behalf. They can help with:

- Evaluating Damage: Providing a thorough assessment of the damage and estimating repair costs.

- Documenting Evidence: Gathering and organizing all necessary documentation to support your claim.

- Negotiating Settlements: Working with your insurance company to negotiate a fair settlement.

- Managing Paperwork: Handling the paperwork and administrative tasks involved in the claims process.

What to Expect from Insurance Companies and Adjusters

Insurance companies and their adjusters play a significant role in determining your claim’s outcome. Expect them to:

- Investigate the Claim: Conduct a detailed investigation to verify the extent of the damage and your policy coverage.

- Communicate Regularly: Keep them informed about the progress of your claim and any additional information they may need.

- Provide a Settlement Offer: Offer compensation based on their assessment and policy terms. Be prepared to review and potentially negotiate this offer.

Key Documents Needed for Claims and How to Prepare

Having the right documents is crucial for a smooth claims process.

Prepare the following:

- Proof of Damage: Photos and videos of the damage.

- Repair Estimates: quotes from contractors or repair professionals.Insurance Policy: A copy of your homeowner’s insurance policy.

- Receipts and Invoices: For any expenses incurred related to the damage.

Filing a homeowners insurance claim in Florida involves several steps, but understanding the process can make it more manageable. By preparing thoroughly, working with public adjusters, and knowing what to expect, you can navigate the claims process more effectively.

Interactive Element: Quick Decision Quiz

You’ve just experienced a major storm, and you notice a few areas of your ceiling that seem discolored. What should be your next step?

- Wait to see if the coloration gets worse before taking any action.

- Paint over the discoloration to make it look better.

- Contact your insurance company and schedule an inspection to assess the potential damage.

Correct Answer: C) Contact your insurance company and schedule an inspection. Discolored ceilings can indicate water damage or other issues needing prompt attention. An inspection can help determine the extent of the damage and whether your insurance policy covers it.

Need help with your home insurance claim in Florida? Contact Justin Miller, our dedicated public adjuster, today. He will handle your claim from start to finish, ensuring a smooth process and faster payout.

Schedule your free consultation now!