Flooding is one of the most devastating natural disasters, and estimating flood damage is crucial for a successful recovery. This comprehensive guide will walk you through the steps needed to create accurate flood loss estimates for dwellings under the National Flood Insurance Program (NFIP). Whether you’re a public adjuster, contractor, or policyholder, this guide will help you understand the process from start to finish.

A Brief History of the National Flood Insurance Program (NFIP)

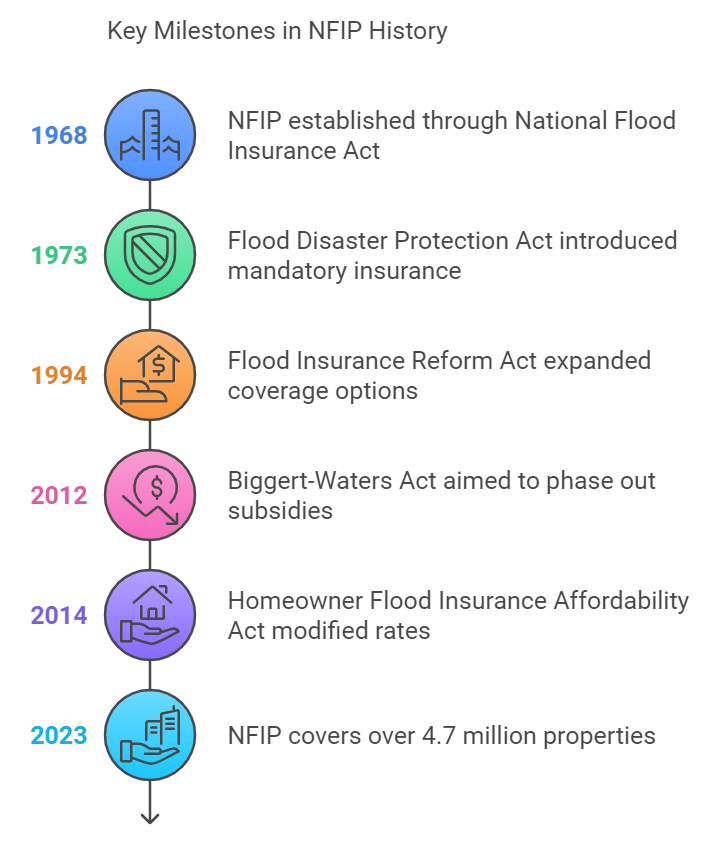

The National Flood Insurance Program (NFIP) was established in 1968 through the National Flood Insurance Act. Before the NFIP, private flood insurance was almost non-existent, and homeowners relied on government disaster relief to recover from floods. The NFIP was created to provide affordable flood insurance while promoting responsible floodplain management to reduce future risks.

Key milestones in the NFIP’s history:

- 1973 Flood Disaster Protection Act: Introduced the mandatory flood insurance purchase requirement for properties in high-risk areas financed by federally backed loans.

- 1994 Flood Insurance Reform Act: Expanded coverage options and strengthened floodplain management requirements.

- 2012 Biggert-Waters Act: Aim to phase out subsidized rates and implement risk-based pricing, but was modified by the 2014 Homeowner Flood Insurance Affordability Act, which limited premium increases to protect policyholders from sudden cost surges.

As of 2023, the NFIP covers over 4.7 million properties and continues to evolve with a modern risk-rating approach designed to more accurately reflect each property’s flood risk.

Step 1: Understanding NFIP Dwelling Coverage

Before you can write a flood loss estimate, it’s essential to understand what the NFIP covers for residential dwellings.

Building Coverage Limits

- Maximum coverage for a dwelling (residential structure) under the NFIP is $250,000.

What’s Covered:

- Foundation and Structural Elements:

- Includes foundation walls, anchorage systems, and staircases attached to the home.

- Electrical and Plumbing Systems:

- Covers wiring, electrical panels, circuit breakers, and plumbing systems like pipes and water heaters.

- HVAC Systems:

- Includes central air conditioning, heat pumps, furnaces, and water heaters.

- Built-In Appliances:

- Built-in refrigerators, stoves, and dishwashers are covered.

- Permanent Fixtures:

- Includes carpeting installed over unfinished floors, cabinets, wallboard, and paneling.

- Detached Garage:

- A detached garage covers up to 10% of the dwelling coverage but reduces the overall available dwelling coverage.

What’s Not Covered:

- Damage to personal contents such as furniture, electronics, and clothing.

- Landscaping, swimming pools, and outdoor structures (fences, decks, etc.).

- Temporary living expenses like hotel stays.

Step 2: Assessment—Initial Damage Evaluation

Before diving into the estimate, a thorough inspection is required.

1. Safety First

Always ensure the property is safe to enter after a flood. Floodwaters can weaken the structure and hide electrical hazards or gas leaks. Equip yourself with proper protective gear, and use moisture meters to check for dampness in walls and flooring.

2. Conduct a Walkthrough Inspection

Perform a visual inspection of the property, marking key areas:

- Flood Line: Document the height of the water on each wall.

- Foundation: Inspect the foundation for cracks, sinking, or signs of erosion caused by floodwaters.

- Interior Damage: Look for warping, staining, or damage to walls, floors, and ceilings.

- HVAC and Utilities: Check for water damage to the HVAC system, water heaters, and electrical panels.

Step 3: Measure and Document Damages

Accurate measurements and thorough documentation are key to writing a reliable estimate.

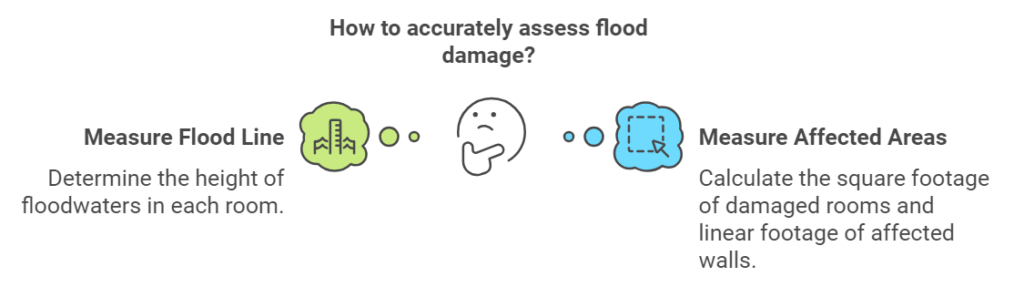

1. Measure the Flood Line

The height of the floodwaters in each room is critical for calculating the extent of the damage. Use a laser or tape measure to record the distance from the floor to the highest waterline. This will help determine which parts of the structure need repair or replacement.

2. Measure Affected Areas

For walls, measure the square footage of rooms that were damaged and calculate the linear footage of the walls affected (height of the waterline multiplied by the length of the wall).

Step 4: Identifying Structural and Fixture Damage

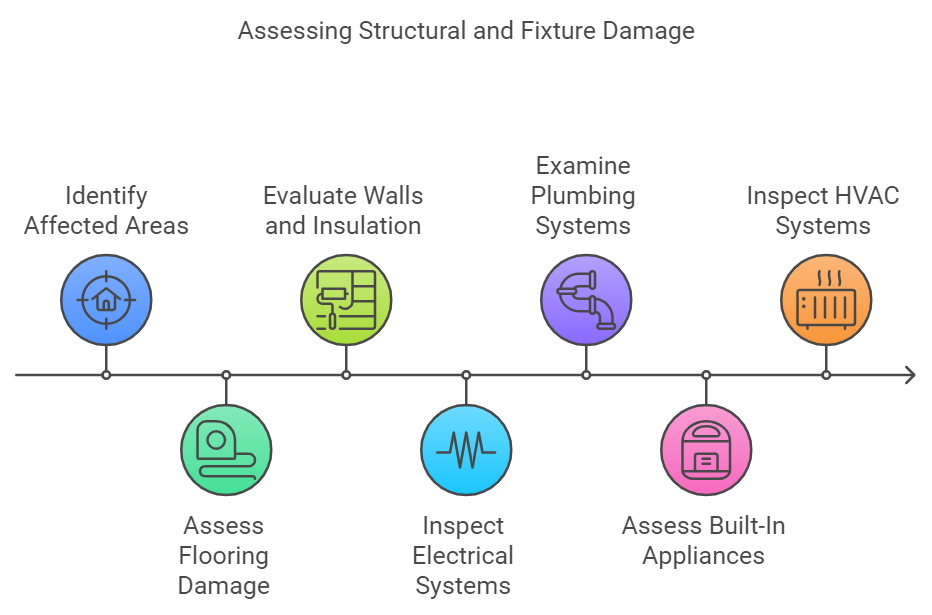

Once the affected areas are measured, focus on assessing specific elements within the home that need repair or replacement.

1. Flooring

- What’s covered: Only permanent flooring, like installed carpet and tile. Area rugs and removable flooring are not covered.

- How to estimate: Calculate the total square footage of damaged flooring for replacement.

2. Walls and Insulation

- What’s covered: Drywall, insulation, and wallboard.

- How to estimate: Estimate based on the linear footage of walls affected up to the waterline. If water reaches high levels, complete removal and replacement of walls may be necessary.

3. Electrical Systems

- What’s covered: Wiring, outlets, fuse boxes, and circuit breakers.

- How to estimate: Evaluate all systems below the waterline for replacement. Electrical systems exposed to water are often damaged beyond repair and may require rewiring.

4. Plumbing Systems

- What’s covered: Pipes, water heaters, and sump pumps.

- How to estimate: Inspect and document damaged plumbing systems, noting those that were submerged.

5. Built-In Appliances

- What’s covered: Dishwashers, ovens, and other built-in appliances.

- How to estimate: Assess appliances for damage and estimate replacement costs.

6. HVAC Systems

- What’s covered: Heating, ventilation, and air conditioning systems, including ductwork.

- How to estimate: HVAC systems are vulnerable to flood damage and often need to be inspected by a professional. Include inspection fees in your estimate and, if needed, the cost of replacement or repair.

Step 5: Calculating the Damage

Once you’ve assessed the damage, it’s time to calculate the costs.

1. Use Industry-Standard Unit Pricing

Apply industry-standard unit pricing (e.g., Xactimate, Marshall & Swift) for labor and materials. This ensures that the cost of repairs is realistic and in line with industry expectations.

- Example: If drywall repair costs $3 per square foot and you have 200 square feet of damaged drywall, that repair would cost $600.

2. Account for Local Variations

Remember that costs vary by region, so adjust for local labor rates and material availability when calculating your estimate.

Step 6: Filing and Documentation

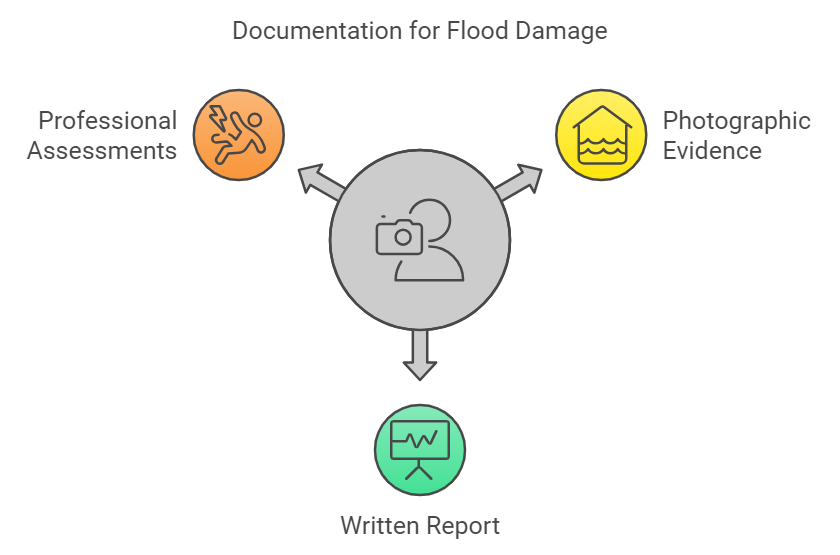

Once the estimate is prepared, ensure you have complete documentation.

1. Photographic Evidence

Take detailed before and after photos of every room and item affected by the flood. Ensure you capture the waterline and document all visible damage.

2. Written Report

Create a detailed written report that breaks down the damage by room and component, with calculated costs for labor, materials, and any necessary replacements. Include inspection reports from professionals for items like electrical systems, plumbing, and HVAC.

3. Include Professional Assessments

For technical systems like HVAC and electrical, include reports from licensed professionals. Their input can ensure your estimates for these areas are accurate.

Bonus Tip: Expert Review and Effective Negotiations

Once the insurance carrier provides their estimate, it’s crucial to bring it to your experts—such as public adjusters or contractors—to review and adjust the line items. This ensures that the estimate reflects real-world pricing for labor and materials and that services can be rendered at actual costs. Carrier estimates may sometimes overlook regional cost differences or certain necessary repairs, so having an expert review ensures your compensation matches the true cost of restoring your home.

Just as important is the role of your representation in building a solid, detailed report for the flood investigator. This report should align with the insurance carrier’s assessment, ensuring that you and the examiner are on the same page. When your adjuster or representative builds a thorough report, it opens the door for more effective negotiations and ensures nothing is overlooked. Proper collaboration with the flood examiner helps prevent gaps in the estimate, speeds up the claims process, and leads to a more accurate settlement.

Important Reminder: Know Your Coverage

Policyholders must understand that a flood insurance policy offers basic coverage—it’s designed to cover structural damages and essential systems but has limits. Knowing what you are covered for while holding the policy can make a significant difference when preparing for a flood event. This awareness allows you to make informed decisions about whether additional coverage or private insurance is necessary, ensuring you’re prepared for potential losses if a flood strikes.

Have questions about your homeowner’s insurance coverage or need help filling coverage gaps? Contact ClaimPros today for expert guidance and assistance in finding the right coverage for your Florida property.