One of the most common concerns for homeowners in Florida is how long it will take to complete a home insurance claim. After an unexpected event like a hurricane, water leak, or theft, the claim process can take forever. In this blog, we’ll break down average timelines for various types of claims, outline factors that can slow down the process, and explain how hiring a public adjuster can expedite things—helping you get paid faster.

Average Timeframe for Different Types of Claims

Home insurance claims can vary significantly depending on the type of damage. The timeline to resolve your claim will depend on factors like the complexity of the damage, the insurer’s workload, and how quickly you can provide documentation.

- Storm Damage Claims: Florida homeowners are no strangers to hurricanes and tropical storms. Storm-related damage claims usually take between 30 and 60 days to process, but that can extend if widespread damage and many claims are being processed simultaneously.

- Water Damage Claims: Claims from water damage caused by leaking pipes, roof issues, or even broken appliances typically take 14 to 45 days. However, if mold remediation is required, the process may take longer.

- Theft or Vandalism Claims: Theft claims are usually resolved faster, taking anywhere from 7 to 30 days, provided you have all necessary documentation, including a police report and an itemized list of stolen property.

It’s important to note that these timelines are estimates. Every claim is unique; delays can occur if additional documentation or inspections are needed.

Factors That Delay Home Insurance Claims

Several factors can delay your claim, but understanding these pitfalls will help you avoid them and keep your claim on track.

- Incomplete Documentation: Missing paperwork is one of the most common causes of claim delays. Insurers require evidence, such as photos of the damage, receipts for repair costs, and proof of ownership for stolen items. The quicker you can provide these documents, the faster your claim can be processed.

- Disputes with Insurers: Insurers may contest the cause of the damage, particularly when it comes to storm-related claims. They may also undervalue the cost of repairs, which can lead to prolonged negotiations. This is especially common when a significant volume of claims are filed after a large-scale event like a hurricane.

- Poor Communication: Delays also occur when communication between you and the insurance company breaks down. Failing to respond to your insurer’s requests for information, or not regularly checking on the status of your claim, can lead to unnecessary hold-ups.

How Public Adjusters Can Expedite the Process

If you want to avoid delays and get paid faster, hiring a public adjuster could be your best decision. A public adjuster works on your behalf to handle all aspects of the insurance claim process. Here’s how they can help:

- Thorough Documentation: Public adjusters ensure that all required documents—photos, estimates, receipts, and more—are submitted to the insurance company promptly and correctly. By doing so, they minimize the chances of back-and-forth requests for additional information, which can slow down your claim.

- Negotiation with Insurers: Insurance companies might try to minimize payouts or delay settlements, especially when dealing with large numbers of claims. A public adjuster is your advocate, fighting for your best interests and ensuring that disputes are resolved quickly and fairly.

- Faster Communication: Public adjusters maintain consistent communication with insurers, following up on your claim’s status and

keeping the process moving forward. They know how to navigate the system to prevent your claim from falling through the cracks.

Florida-Specific Guidelines for Insurance Response Times

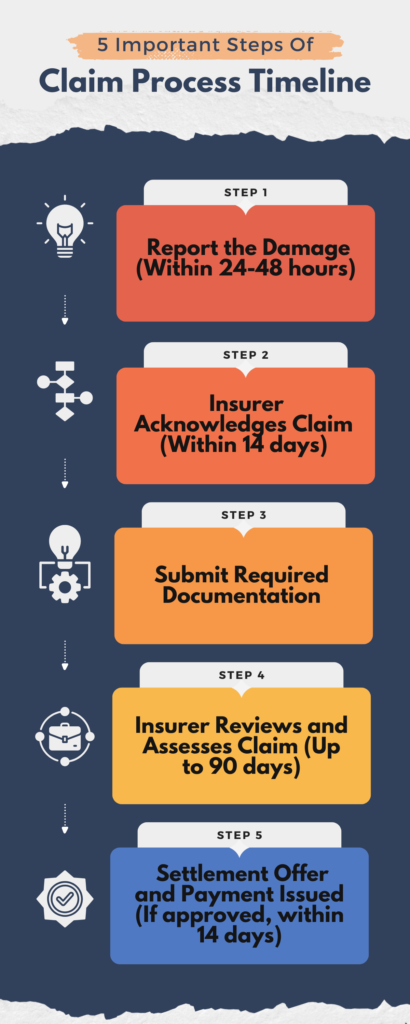

Florida law sets specific timeframes that insurers must follow when processing claims. These guidelines can help you understand what to expect when you file a claim:

- Initial Acknowledgment: Once you submit your claim, the insurance company must acknowledge receipt of it within 14 days. This initial step is crucial as it signals that your claim is officially in the system.

- Decision Timeline: After all documentation has been submitted, the insurer must decide on your claim—whether to accept or deny it—within 90 days. If there are issues or disputes, this can take longer, but knowing this deadline can help you stay on top of the process.

The time it takes to resolve a home insurance claim in Florida depends on the type of claim and how well the process is managed. Factors like incomplete documentation, disputes with insurers, and communication issues can all lead to frustrating delays. By working with a public adjuster, you can navigate the system more efficiently, speed up your claim, and receive your settlement as quickly as possible.

Interactive Element: Quick Decision Quiz

You’ve filed a home insurance claim for storm damage, and your insurance company requests additional documentation, which you’ve already submitted. It’s now been 60 days with no further updates. What should you do next?

- Wait patiently—processing claims takes time.

- Call your insurer every week to remind them.

- Hire a public adjuster to help speed up the process and ensure your claim stays on track.

Correct Answer: C) Hire a public adjuster to help speed up the process and ensure your claim stays on track. Public adjusters are experts in handling claims and can advocate for faster resolution, especially when insurers seem unresponsive.

Need help with your home insurance claim in Florida? Contact Justin Miller, our dedicated public adjuster, today. He will handle your claim from start to finish, ensuring a smooth process and faster payout.

Schedule your free consultation now!