Understanding the deadlines for filing homeowners insurance claims is crucial for ensuring you receive the compensation you deserve. In Florida, where the risk of natural disasters like hurricanes is high, timely filing can significantly affect your claim’s outcome. This blog will clarify the deadlines you need to know, the consequences of missing these deadlines, and how public adjusters can assist you in navigating the process.

Specific Deadlines for Different Types of Claims

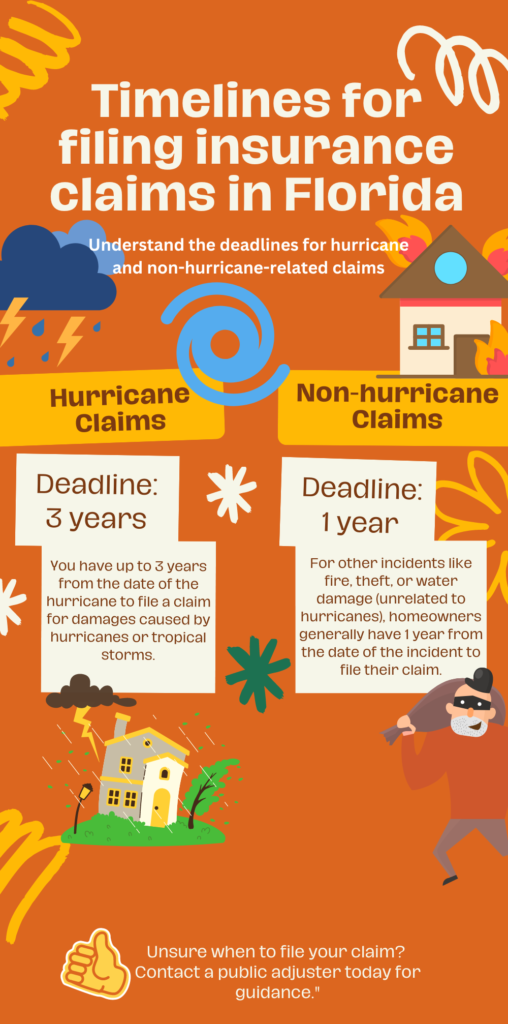

In Florida, the deadlines for filing insurance claims can vary depending on the type of claim:

Non-Hurricane Claims: For non-hurricane-related claims, such as those for fire or theft, you generally have one year from the incident date to file your claim. It’s important to report damages as soon as possible to avoid complications.

Hurricane Claims: After a hurricane or tropical storm, homeowners typically have three years from the date of the storm to file a claim. This extended deadline accounts for the complex nature of hurricane damage and the need for thorough assessments.

Consequences of Missing Deadlines

Missing the filing deadline can have significant consequences:

Legal Issues: In some cases, missing deadlines may lead to legal disputes or difficulties recovering damages.

Claim Denial: If you file your claim after the deadline, insurance companies may deny it, leaving you responsible for repair costs.

Reduced Compensation: Even if your claim is accepted after the deadline, you might receive a reduced payout or face complications in the claims process.

How Public Adjusters Ensure Timely Filing

Public adjusters can play a vital role in ensuring that your insurance claims are filed within the required deadlines:

- Prompt Documentation: They help gather and document evidence of damage promptly, ensuring that no time is wasted in the claims process.

- Navigating Policy Details: Public adjusters are familiar with the specific requirements of your insurance policy and can ensure that all necessary paperwork is completed accurately and on time.

- Timely Communication: They handle communication with your insurer, making sure that all deadlines are met and follow-ups are performed as needed.

- Guiding You Through the Process: From initial filing to final settlement, public adjusters guide you through each step, ensuring that you adhere to all timelines and requirements.

Understanding and adhering to the deadlines for filing homeowners insurance claims in Florida is essential for ensuring that you receive the full compensation you are entitled to. Whether dealing with hurricane damage or other types of incidents, timely filing can prevent complications and delays. Public adjusters can be a valuable resource in managing your claim process, from timely filing to navigating the complexities of insurance policies.

Interactive Element: Quick Decision Quiz

A hurricane has just passed through your area, causing noticeable damage to your roof and siding. You’re unsure about the next steps for filing an insurance claim. What should you do?

- Wait until the storm-related chaos settles before taking any action.

- Immediately start gathering repair estimates and file a claim with your insurer as soon as possible.

- Assume that you have plenty of time and deal with the damage when it’s more convenient.

Correct Answer: B) After a hurricane, it’s crucial to start the claims process as soon as possible. Promptly gathering repair estimates and filing a claim ensures you adhere to the three-year deadline for hurricane claims and helps in managing repairs effectively. Waiting or delaying action can complicate the claims process and potentially affect the compensation you receive.

Need assistance with filing a homeowners insurance claim or ensuring you meet all deadlines? Contact ClaimPros today to schedule a consultation with a skilled public adjuster who can help you navigate the process and maximize your claim.