Florida is known for its beautiful beaches, sunny weather, and vibrant lifestyle. However, its unique climate and susceptibility to natural disasters, such as hurricanes, pose significant challenges for homeowners seeking insurance coverage. If you’re a Florida resident or planning to move to the Sunshine State, understanding how to secure homeowners insurance despite these challenges is crucial. This blog will address your concerns about obtaining coverage in a high-risk state, explore available insurance options, and offer tips for managing rising premiums.

Challenges of Getting Homeowners Insurance in Florida

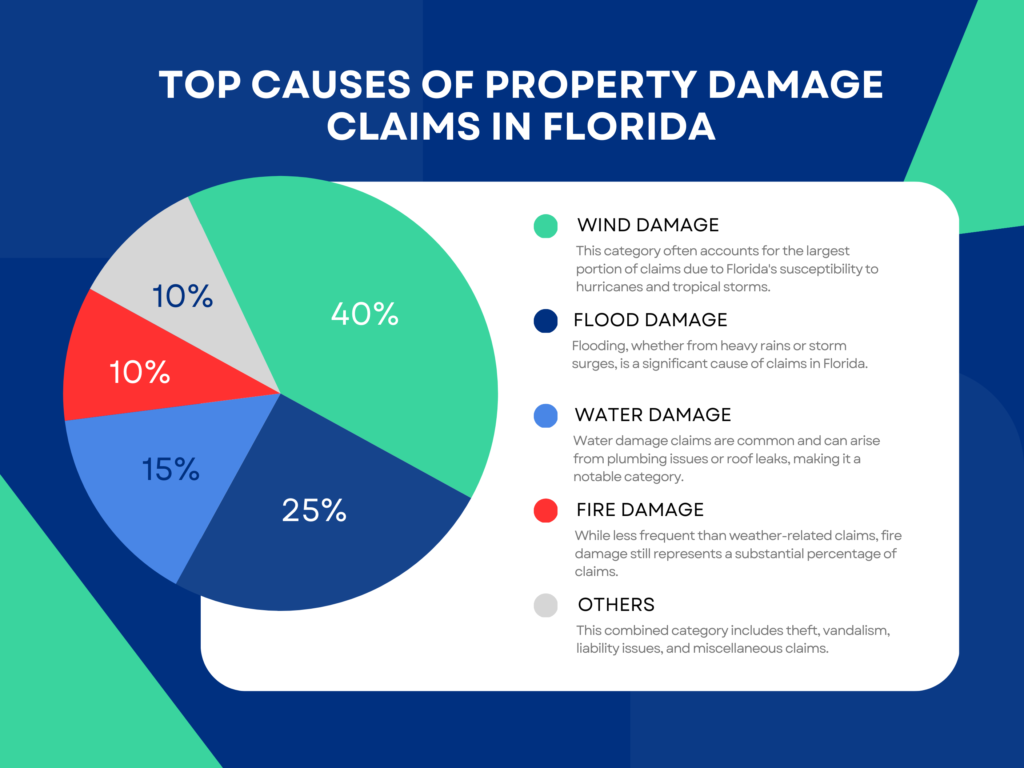

Florida’s geographic and climatic factors contribute to its high-risk status for homeowners insurance. The state frequently experiences hurricanes, heavy rainfall, and flooding, which can result in substantial property damage. These factors make insurers categorize Florida as a high-risk state, making it more challenging for homeowners to secure affordable coverage.

Insurers often face significant losses from claims related to storm damage and flooding, which drives up premiums. Additionally, the frequency of insurance claims has led to stricter underwriting standards and more limited coverage options. As a result, many homeowners find themselves grappling with higher costs and fewer choices when shopping for insurance.

Available Insurance Options for Homeowners in High-Risk Areas

Despite these challenges, there are still several options available for homeowners in Florida:

- Private Insurance Companies: Some private insurers specialize in high-risk areas and offer coverage tailored to Florida’s unique needs. These companies may provide policies with specific provisions for hurricane and flood damage.

- Citizens Property Insurance Corporation: As Florida’s state-run insurer of last resort, Citizens offers coverage for homeowners who cannot find insurance through the private market. While this option can be a lifeline, reviewing the policy details carefully is essential, as coverage may be limited compared to private insurers.

- Flood Insurance: Standard homeowners insurance typically does not cover flood damage. To protect against this risk, homeowners should consider purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP) or private flood insurers.

- Hurricane Insurance: Some insurers offer specialized hurricane insurance to cover wind and storm surge damage. This can be a valuable addition to a standard homeowners policy.

Tips for Securing Affordable Coverage Despite Rising Premiums

- Increase Your Deductible: Opting for a higher deductible can lower your premium. However, ensure that you can comfortably afford the deductible in the event of a claim.

- Fortify Your Home: Investing in hurricane-resistant features such as impact windows, reinforced roofs, and sturdy doors can reduce your risk and potentially lower your insurance premiums.

- Shop Around: Obtain quotes from multiple insurers to compare coverage options and find the best rate. Different insurers may offer varying levels of coverage and discounts.

- Bundle Policies: Consider bundling your homeowner’s insurance with other policies, such as auto insurance, to qualify for discounts.

- Maintain a Good Credit Score: Insurers often use credit scores to determine premiums. Maintaining a good credit score can help you secure more affordable rates.

How Public Adjusters Help in Finding Insurance-Friendly Repairs Post-Claim

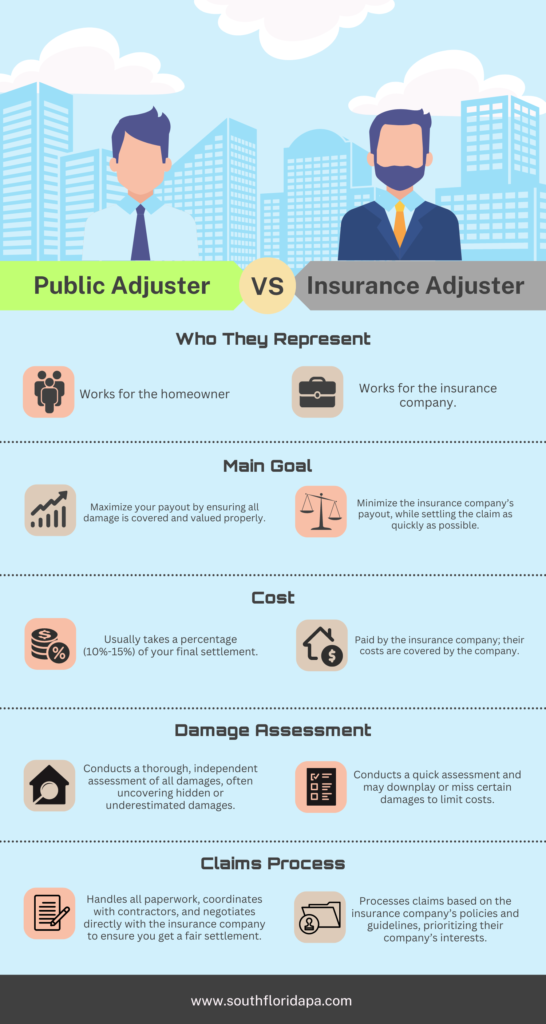

After experiencing property damage, homeowners often face the challenge of repairing their homes in a way that aligns with insurance requirements. Public adjusters can play a crucial role in this process by:

- Assessing Damage: Public adjusters provide thorough assessments of damage to ensure all necessary repairs are identified and documented. This helps in filing accurate claims and avoiding underestimations.

- Navigating Insurance Policies: They can interpret complex insurance policies and advise on the types of repairs that will be covered under your policy.

- Coordinating with Contractors: Public adjusters can recommend reputable contractors who perform repairs that meet insurance standards and guidelines.

- Negotiating Settlements: They negotiate with insurance companies to ensure you receive a fair settlement for your claim, taking into account the cost of necessary repairs.

Securing homeowners insurance in Florida may be more challenging due to the state’s high-risk profile, but it is not impossible. By understanding the available options, implementing strategies to manage rising premiums, and seeking assistance from public adjusters, you can better navigate the complexities of obtaining and maintaining coverage. If you need help with insurance claims or finding insurance-friendly repairs, consider reaching out to a public adjuster to guide you through the process.

Interactive Element: Quick Decision Quiz

You’ve just received your homeowner’s insurance renewal notice and noticed a significant increase in your premium. What should you do next?

- Accept the new premium rate without question.

- Start searching for a new insurance provider immediately.

- Review your current policy, check for discounts or adjustments, and consider contacting your insurer to discuss options.

Correct Answer: C) Reviewing your policy and discussing options with your insurer can help you understand the reasons behind the increase and potentially

Find ways to lower your premium. Starting with these steps ensures you make informed decisions rather than jumping to conclusions.

Ready to tackle your homeowner’s insurance challenges in Florida?

Contact us today to schedule a consultation with a knowledgeable public adjuster who can assist with your insurance claims and repair needs.